Looma does to car insurance what credit scoring did to personal finance.

Car insurance pricing can be a mystery, but not with Looma.

Looma makes it transparent. Looma gives drivers control, insurers trust, and everyone with fairer, longer-lasting relationships and better policies.

Everything your insurer knows, now visible to you.

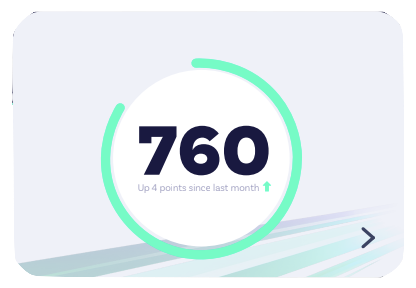

Looma Score

Track, maintain and improve your insurance behaviour through a bespoke scoring algorithm.

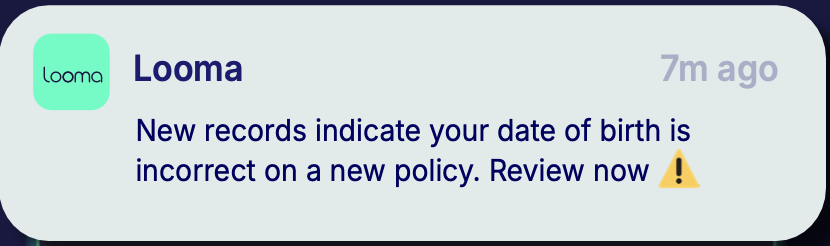

Spot anomalies

Spot errors and anomalies in your insurance history that might be increasing your premium.

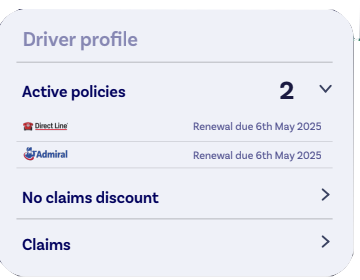

All in one place

See everything in one place — policies, claims, penalties, your no‑claims discount, and more.

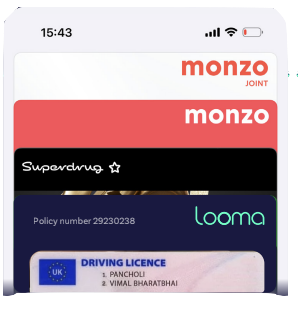

Digital wallet

Easily access your policy and driving licence in your phone’s digital wallet.

Find ways to save

Find ways to cut your costs by focusing on what you can actually control.

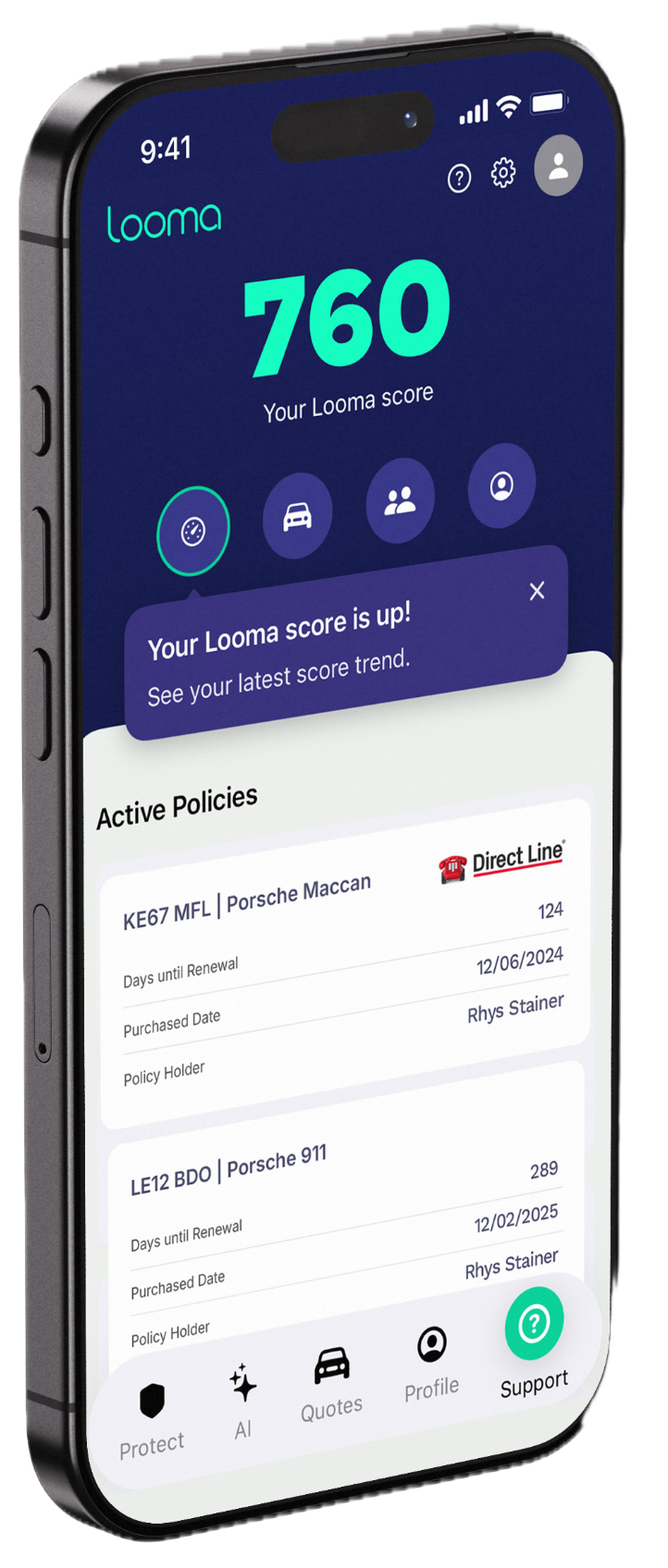

Your insurance dashboard

With Looma , you can finally see what insurers see, making pricing feel fair and transparent.

Check your Looma score, spot errors that could cost you, and get alerts when your score changes or when it’s time to switch.

Your digital wallet keeps your licence and policy in one place, while personalised tips and instant notifications help you improve your profile and unlock better quotes.

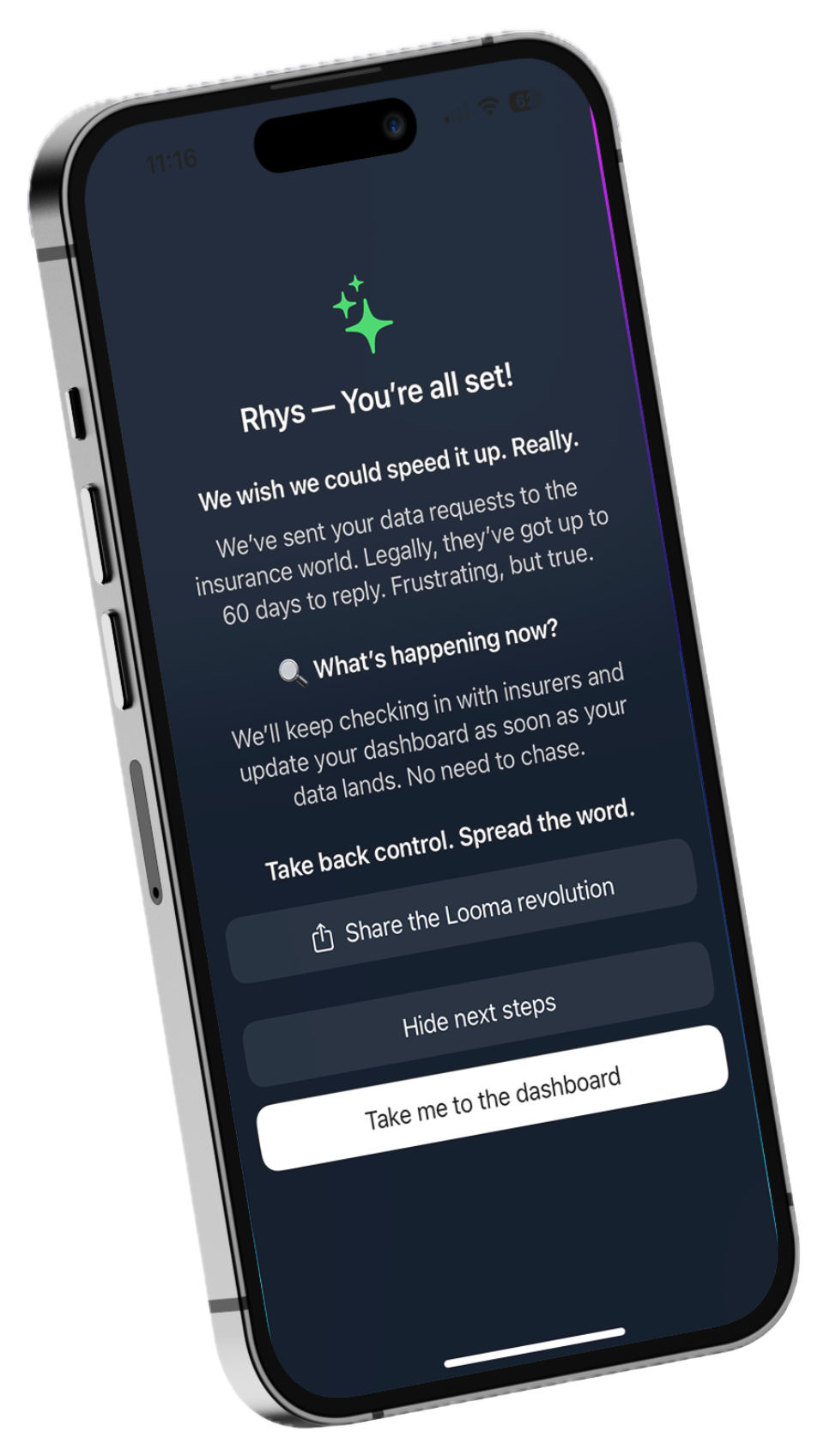

Looma is ambitious.

We’re building the first public insurance profile, giving motorists the same clarity and control that credit scoring brought to personal finance.

For the first time, you’ll be able to see how insurers view you, understand your Looma score, and take action to make pricing feel fair and transparent.

Looma puts you in the driver’s seat. From fixing data errors and spotting fraud, to getting smarter quotes and managing your policy more easily.

It’s about trust, transparency, and giving power back to motorists.